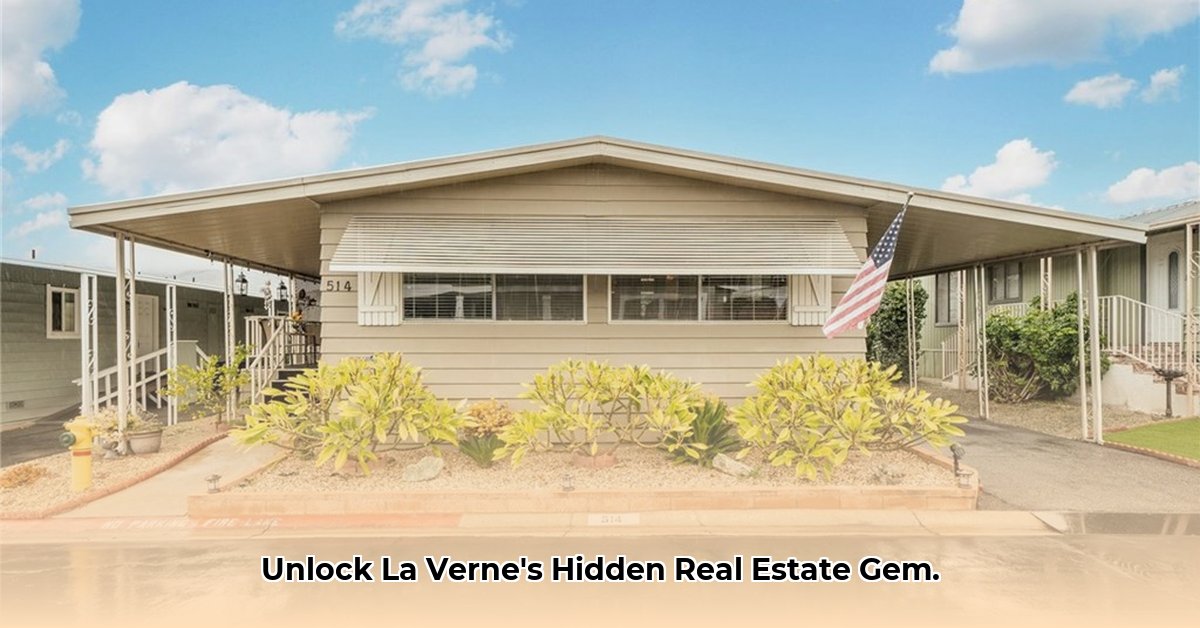

Foothill Terrace La Verne CA: A Detailed Investment Analysis

This report analyzes the investment potential of Foothill Terrace Mobile Home Park in La Verne, California, a senior-focused community. We assess its strengths, weaknesses, and potential risks, providing a framework for informed decision-making.

Occupancy and Rental Income: A Key Performance Indicator

Foothill Terrace maintains exceptionally high occupancy rates, with only two vacant sites out of 376 (99.5% occupancy). Monthly rental rates range from $400 to $750, averaging approximately $845. This consistent rental income stream forms a strong foundation for potential returns. However, historical performance does not guarantee future results. A comprehensive market analysis is needed to project long-term stability and rental growth.

Senior-Friendly Amenities and Market Positioning

Targeting the 55+ demographic, Foothill Terrace offers amenities including a clubhouse, swimming pool, and recreational areas to enhance residents’ quality of life. The pet-friendly policy (with reasonable weight limits) further broadens its appeal. These features contribute to sustained high occupancy and attract prospective residents. This strategic focus on a specific demographic minimizes competition and potentially strengthens pricing power.

Age and Maintenance Considerations: Capital Improvements

The park’s age (reportedly built in either 1971 or 1973) necessitates careful consideration of infrastructure maintenance and potential future capital expenditures. A thorough inspection of utilities (water, sewer, electrical, gas, and stormwater systems) is essential. Proactive planning includes a staged capital improvement plan to extend the lifespan of the property and maintain its value and appeal. Deferred maintenance can significantly impact profitability and property value over time.

La Verne Market Analysis: External Factors

A comprehensive analysis of the La Verne real estate market is crucial for determining Foothill Terrace's potential. This involves comparing property values, rental rates, and market trends for similar mobile home communities. Factors such as the proximity to amenities (e.g., water access approximately 1.4 miles away) and local zoning regulations are critical considerations. Understanding the broader economic climate and future demand projections in this market segment will contribute significantly to the overall risk assessment.

Isn't a comprehensive understanding of the local market essential for a successful investment? The data suggests a need for further investigation into projected rental growth in La Verne.

Actionable Steps: A Phased Investment Strategy

A strategic plan is vital for maximizing returns. The following steps outline both short-term and long-term actions:

Short-Term (0-1 Year): Immediate Actions

- Due Diligence: Conduct a thorough physical inspection, detailed financial analysis, and secure appropriate financing.

- Market Research: Optimize rental rates based on thorough market research to ensure competitive positioning.

- Maintenance: Address urgent infrastructure repairs and implement a preventative maintenance program.

Long-Term (3-5 Years): Strategic Planning

- Capital Improvements: Develop a robust capital improvement plan based on the thorough infrastructure assessment. Prioritize upgrades to enhance resident satisfaction and increase property value.

- Revenue Enhancement: Explore strategies to increase rental income, such as planned renovations or amenity upgrades.

- Market Monitoring: Continuously monitor local market trends and adjust strategies accordingly.

Risk Assessment and Mitigation: Potential Challenges

While Foothill Terrace presents potential, risk mitigation is crucial. Potential risks and associated mitigation strategies are summarized below:

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Infrastructure Deterioration | Moderate | High | Proactive maintenance and a comprehensive capital improvement plan |

| Vacancy Rate Increase | Low | Medium | Effective marketing, well-maintained property, competitive pricing |

| Regulatory Changes | Low | Medium | Regular monitoring of local regulations and proactive engagement |

| Market Downturn | Low | High | Diversification of investments and secure, long-term financing |

How to Assess Infrastructure Needs in a Senior Mobile Home Park: A Detailed Guide

Understanding the condition of the existing infrastructure is paramount. Ignoring this can lead to significant financial setbacks. The following section details the key areas of focus:

Essential Systems Assessment: A Detailed Checklist

- Water and Sewer Systems: Conduct a professional inspection to assess the condition of pipes, pumps, and treatment facilities. Identify potential leaks, rust, or other issues requiring immediate attention. Plan for future replacements or upgrades based on system age and expected longevity.

- Electrical and Gas Systems: Verify that electrical and gas systems are up to code and adequately sized to meet current and future needs. Upgrades to energy-efficient systems can enhance operating efficiency and appeal to potential residents.

- Stormwater Management: Inspect drainage systems, addressing any signs of erosion, clogging, or inadequate capacity. Proactive landscaping and regular maintenance are preventative measures.

Proactive Maintenance and Long-Term Planning: A Roadmap for Success

Investing in mobile home parks is a long-term commitment. A comprehensive capital improvement plan should prioritize preventative maintenance to minimize unforeseen disruptions and costs. Regular inspections, budget allocation for repairs, and contingency planning for emergencies are essential components of a robust approach.

Navigating Regulatory Compliance: Key Considerations

Understanding and adhering to local regulations and building codes is crucial for mitigating legal risks and ensuring compliance. Consult with legal professionals to ensure all permits are up-to-date and current regulations are followed.

Conclusion: Investment Decision Framework

Foothill Terrace presents a compelling investment opportunity, driven by high occupancy rates, desirable amenities, and a strategic focus on a sought-after demographic. However, potential risks associated with infrastructure maintenance and market fluctuations must be carefully weighed. A thorough due diligence process, comprehensive market analysis, and a well-defined capital improvement plan are essential for navigating these challenges and maximizing returns. The ultimate investment decision rests upon a meticulous assessment of all these factors.